The interaction between purchase aspect liquidity and promote https://divinegallerymumbai.com/tips-on-how-to-create-a-crm-technique-examples/ facet liquidity is a continuing driver of those dynamic movements. Liquidity is like the convenience with which items (or in our case, financial assets) can be bought and offered with out causing a major worth ruckus. In essence, it’s a measure of how many buyers and sellers are current and whether or not trades can occur shortly and easily at secure prices.

Thus, it’s a versatile technique that might be adapted to a sure state of affairs in the market. Traders can even use different technical indicators, similar to pattern traces and transferring averages, to substantiate potential reversal points further. Industry-leading electronic order routing with the flexibleness to optimize performance wants while navigating a fancy and ever-changing market structure. Related to all US Possibility and Fairness exchanges, in addition to main darkish swimming pools, our proprietary buying and selling algorithms are designed to maximise liquidity seize, while minimizing costs. Any action you’re taking upon the data on this web site is strictly at your personal risk and we won’t be responsible for any losses and damages in connection with the use of our web site content. Soft-FX is a software program growth and integration company and does not provide monetary, change, funding or consulting providers.

- On the promote aspect, the regulation aims more at market integrity and transparency in being middlemen.

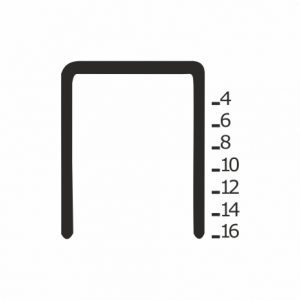

- Sell facet liquidity zones often kind just under important support levels.

- Mastering strategies round sell facet liquidity is crucial for navigating the more and more advanced markets of 2025.

- Once a swing excessive is taken, that buy aspect liquidity is no longer related, and a spotlight shifts to the next clear high.

- ICT traders monitor the market classes and look for particular times when trading quantity is high enough to move costs quickly.

Right Here are some suggestions that will assist you commerce more successfully and keep away from frequent pitfalls. Buying And Selling round buy aspect liquidity and promote https://www.xcritical.com/ side liquidity inherently includes volatility. A “liquidity grab” or “stop hunt” is when value briefly pokes above a key excessive (tapping into buy aspect liquidity) or below a key low (tapping into promote side liquidity) only to reverse sharply. Liquidity on the purchase side offers an avenue for purchase facet price movement if sufficient buyers are nonetheless in the market.

Key Gamers In Liquidity

Diversification, hedging, and asset allocation measures reduce publicity to explicit risks, which is done by buy-side firms. Buy-side entities characterize a wide and varied group of traders Yield Farming , every enjoying a distinct however crucial function in today’s monetary markets. Place stop-losses beyond recent liquidity sweeps to avoid being stopped out throughout unstable moves. Retail merchants usually create these zones with out realizing it, whereas massive establishments take advantage of them. By recognizing these areas, traders can observe the moves of larger gamers and avoid common mistakes. These superior ideas usually take a glance at purchase side liquidity and sell aspect liquidity from an institutional perspective.

Definition Of Liquidity In Markets

Understanding these distinctions is important for traders developing strong strategies. As inventory market liquidity adjustments in 2025, mastering the nuances between sell sell side liquidity aspect liquidity and buy aspect liquidity can imply the difference between seizing alternatives and lacking out. Understanding the connection between promote facet liquidity and worth discovery is crucial.

This article will dive deep into the mechanics of liquidity, contrasting promote side vs buy side and exploring how traders can leverage these insights. Access TradingView’s charts, real-time information, and instruments, all in one platform. Sell aspect liquidity might create large downward actions, but those actions could also be adopted by an equally robust movement upward if buyers step in to buy after all the stops had been cleared. Stops respecting untested adjacent zones stability rewarding trends with minimizing the drawdowns if reversed. Skilled traders normally enter after liquidity was taken from the area rather than on the primary test of that liquidity space.

All The Time analyze greater timeframes (like 4H or Daily) earlier than making a commerce. These charts help you see where main liquidity zones, key support/resistance, and general pattern direction are forming. A market with low liquidity results in longer commerce times and risky costs whereas making it unsafe to enter or exit positions. The lack of liquidity creates conditions that end in slippage and increased trading dangers. Transferring averages indicator offers flexible help and resistance boundaries which frequently match liquidity zones.

Institutional And Regulatory Developments

Nonetheless, it could represent a degree of exhaustion if prices can not preserve above this stage. The main news can trigger sharp strikes as the market resumes a longtime development or if the range ultimately breaks out of indecision. In quiet periods with no huge news or occasions, the ranges widen in a free check of wills on each side.

Once the stops are hit, establishments may reverse the value, capturing liquidity from retail merchants. If a market isn’t very liquid, attempting to purchase or sell can be like trying to wade by way of treacle – gradual, and you might not get the price you need. This can lead to what’s known as ‘slippage,’ where the price strikes in opposition to you between the time you place your order and when it truly executes. High liquidity, on the other hand, often means tighter spreads (the distinction between shopping for and selling prices) and a smoother buying and selling experience.