Tips On How To Use Fibonacci Retracements & Extensions

Fibonacci retracement ranges are horizontal traces that indicate the attainable support and resistance ranges the place value might probably reverse path. Fibonacci makes use of ratios that are based on math to recommend possible zones of assist and resistance in financial markets. These zones are not precise levels, but rather areas the place worth might bounce or reverse. Price doesn’t at all times reach or respect these zones, so traders must be flexible and never expect precise ranges. When putting stop and restrict orders, merchants should Proof of stake permit some room for price to move around the Fibonacci zone. The Fibonacci retracement device plots share retracement strains based mostly upon the mathematical relationship within the Fibonacci sequence.

Advocates argue there are observable patterns and recurring ratios in historical value actions across various monetary markets. They consider these patterns mirror the natural ebb and move of market sentiment, and that a trader’s consciousness of those ranges might help them spot optimum entry and exit factors as nicely as identify the place costs and developments could reverse. The allure of the Fibonacci sequence and its relevance in nature inevitably piques curiosity when it’s applied to monetary markets. However, the secret’s understanding that Fibonacci retracement levels, whereas useful, are simply one of many instruments in a trader’s toolkit. They are finest used at the side of a complete trading strategy and a disciplined method.

Do Costs Really Observe Fibonacci Patterns?

Now, the expectation is that if AUD/USD retraces from the recent https://www.xcritical.com/ excessive, it’ll find help at a kind of Fibonacci retracement levels because traders will be inserting buy orders at these ranges as the price pulls again. Entry expert-led trading courses masking futures fundamentals, methods, and danger management—designed to help merchants of all ranges develop their market data. In addition to price levels, Fibonacci ratios can additionally be utilized to time.

However, others view Fibonacci evaluation as mere coincidences or self-fulfilling prophecies, meaning they work only as a result of sufficient people use them—not as a result of they’re divining natural patterns in the market. Interestingly, this sequence isn’t just a numerical marvel; it manifests in various pure phenomena, together with the arrangement of leaves on vegetation, the spiral of galaxies, and even the proportioning of options in human faces. The market did try to https://www.mchukwimissionhospital.co.tz/2024/02/27/10-advantages-of-crm-platforms-tips-on-how-to/ rally, and stalled under the 38.2% level for a bit earlier than testing the 50.0% level. Now, let’s see how we would use the Fibonacci retracement device throughout a downtrend.

Fibonacci Buying And Selling Strategies: Evaluation, Methods, And Debates

These retracement ranges present assist and resistance levels that can be utilized to focus on value objectives. Whereas it may seem confusing at first, there plenty of benefits to Fibonacci trading. Fibonacci buying and selling permits merchants to discover out stop-loss ranges, set price targets, and place entry orders. Then, it retraces to 38.2% Fibonacci level and begins to maneuver greater again. Because that retracement occurred at a Fibonacci level the dealer has a good suggestion where the worth is going to maneuver after retracement and then might resolve to purchase the contract. When you break Fibonacci levels all the means down to the naked bones, they’re simply a device that helps traders determine help and resistence levels.

1000’s of years in the past, mathematicians discovered that a sure number saved appearing throughout the pure world. It was the ratio describing how flower petals grew round their central stem, how a snail’s shell swirled round its origin and how a galaxy extended from its core. Extra importantly for the monetary group, this ratio described how consecutive numbers associated to one another. This “golden ratio” of .618 was utilized to numbers by the thirteenth century mathematician Leonardo Fibonacci.

Hedging And Danger Management

- This tool is recognized as the Fibonacci extension or Fibonacci growth, and it can be applied to any market.

- Full-service buying and selling account with 24-hour access and tailored methods.

- Monetary markets are influenced by a multitude of things, together with elementary news, geopolitical occasions, and market sentiment, which may override the influence of Fibonacci ratios.

- Right Here we plotted the Fibonacci retracement ranges by clicking on the Swing Low at .6955 on April 20 and dragging the cursor to the Swing Excessive at .8264 on June 3.

By Way Of these support and resistence ranges a trader can then determine exit, entry, and stop-loss levels to higher profit themselves. Fibonacci retracement trading a well-liked technical device used by merchants to determine value action. Fibonacci retracement buying and selling is taking two excessive factors from a contract’s price, usually a high and a low, then dividing it by a Fibonacci ratio to determine help and resistance levels. Traders use Fibonacci retracements to identify levels of support and resistance on charts and use Fibonacci extensions to determine value targets. In this article, we’ll explain the idea and foundations of utilizing Fibonaccis for technical traders.

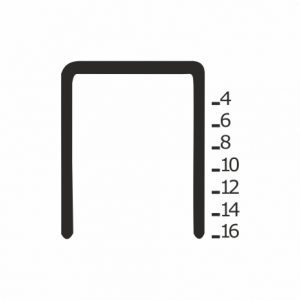

This device is identified as the Fibonacci extension or Fibonacci enlargement, and it can be applied to any market. The most important trading indicators ranges to observe when utilizing Fibonacci retracements are the 38.2% and sixty one.8%. The 50% degree is not actually a Fibonacci stage, but many charting tools embody it and a lot of traders contemplate it a significant point (the midway point of the measured range). As Quickly As a big value transfer has occurred, such as a breakout from a consolidation range, merchants can use Fibonacci extensions to project potential value targets for the following section of the pattern. If they have been that simple, merchants would all the time place their orders at Fibonacci retracement levels and the markets would trend endlessly.

A retracement of 100% of the transfer provides a very robust support/resistance line. The one and two thirds ranges are really approximations of the Fibonacci ratio 61.8% and its inverse. As you can see, Fibonacci levels are merely refined variations of what merchants have been utilizing for years. To assemble Fibonacci arcs, a dealer can choose two pivot points—usually a swing low and swing high—and draw a line connecting them. They would then draw three arcs that intersect with the line based mostly on the Fibonacci ratios of 38.2%, 50%, and sixty one.8% (see determine 2). The idea is that these curves could act as potential ranges of help and resistance for the worth.